E-invoice helpdeskĭo you supply goods or services to the Dutch government and do you want to send e-invoices? You can consult the e-invoice helpdesk's infographic (in Dutch). All government organisations (such as ministries, municipalities, provinces, and non-departmental public bodies) are obliged to be able to receive and process e-invoices.

You can submit an e-invoice online by using, for example, the organisation's electronic letterbox Digipoort, your accounting software, or the central government's suppliers portal. If you carry out work for the Dutch central government, you are obliged to send an e-invoice. Send electronic invoices to government bodies Electronic and digital invoices must satisfy the same requirements.

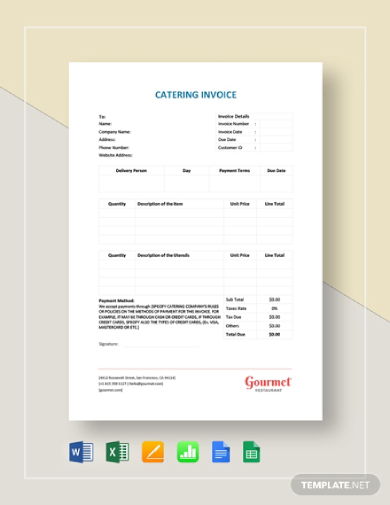

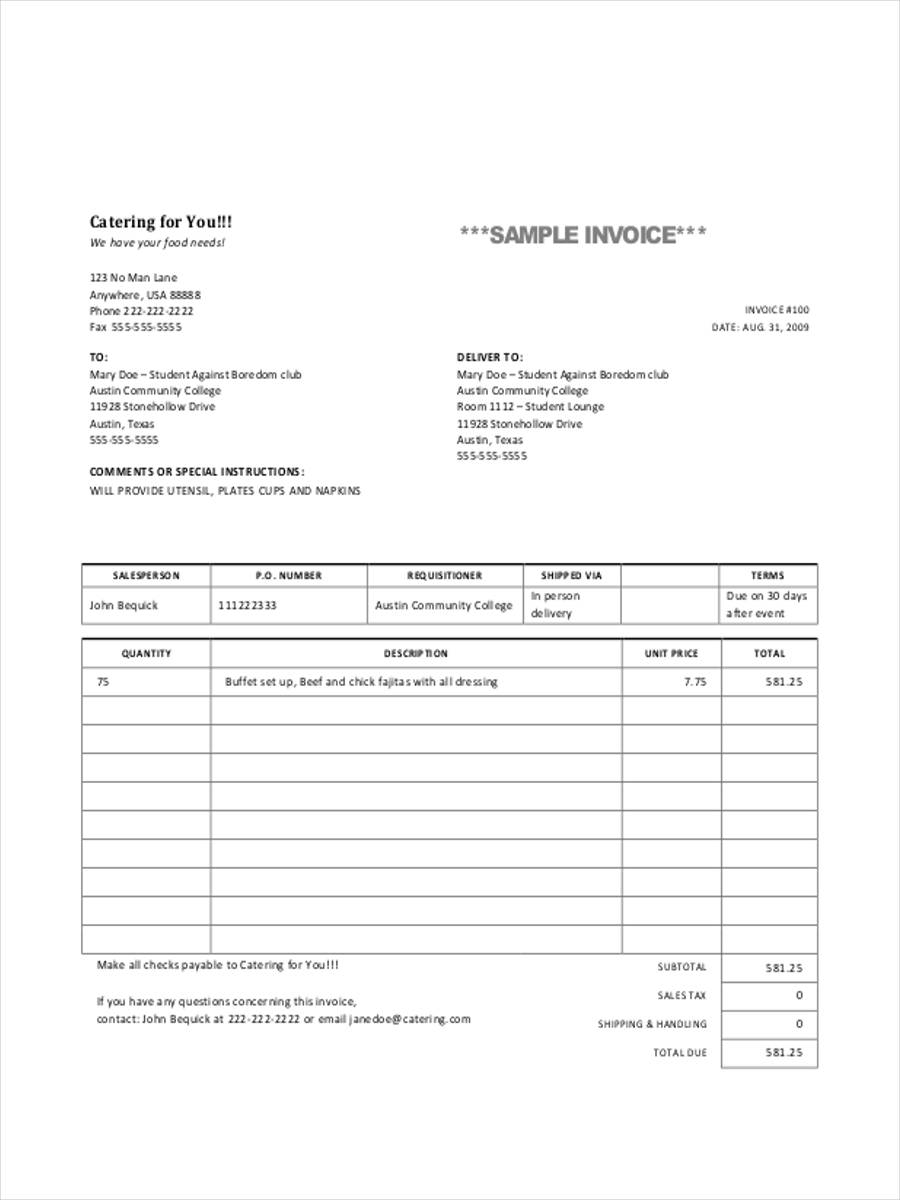

#Sample invoices for catering services pdf

If you send a digital invoice, you send an invoice as pdf by email. E-invoicing, also known as e-billing, is an accepted method of invoicing throughout the European Union (EU). This is not mandatory, unless you carry out work for the Dutch central government. You must ensure your customer has agreed to accepting an e-invoice first. In this case, your e-invoice is sent directly through an automated system to your customer.

#Sample invoices for catering services software

You can send a paper invoice by post, or you can send an electronic ( e-invoice ), or a digital invoice.Įlectronic invoicing or e-invoicing is done through accounting software or a portal. You have to keep invoices relating to immovable property for 10 years. Note that electronic invoices must contain the same information as the original paper invoices. You can issue, receive, and store your receipts and invoices in electronic format. If you send your customer a reminder before the end of the time limit, it will start again.

Rules on sending invoices to private individuals

It is up to you to decide how the invoice is formatted (the design and/or layout), as long as you include the required information. If you provide goods or services to another EU country, you must also indicate your customer’s VAT identification number. This is particularly important for VAT purposes: if your invoices do not meet the requirements, your buyer will not be entitled to a VAT deduction.

You have to rectify invoices that do not fulfil these requirements. your Dutch Business Register number ( KVK-nummer) if you have one.An invoice must state a number of details: If you run a business based in the Netherlands, your invoice has to meet legal requirements. private individuals, but only in a few specific cases (in Dutch) see paragraph 'rules on sending invoices to private individuals'.legal entities who are not entrepreneurs (for example, associations and foundations).You must send an invoice if you supply goods and services to:

0 kommentar(er)

0 kommentar(er)